Preparing Your Business for Singapore’s Contactless Payment Future: A Strategic Contactless POS System Upgrade Guide

Singapore’s digital payment landscape has reached a tipping point. 90% of consumer payments in Singapore are now made through digital channels, while more than nine in 10 Visa transactions made by Singapore consumers are contactless payments—one of the highest adoption rates globally. For retail and F&B businesses, upgrading to a modern contactless POS system Singapore businesses rely on isn’t just a trend to watch—it’s a fundamental shift that demands immediate attention.

As we approach the peak event season from August through November, businesses face a critical window to upgrade their payment infrastructure. This comprehensive guide examines the practical steps, real costs, and measurable benefits of modernizing your contactless POS system for Singapore’s evolving marketplace.

The Current State of Contactless POS Systems in Singapore

The numbers tell a compelling story. According to a survey on consumer payment behavior conducted in 2022 in Singapore, 52 percent of respondents stated that they had used mobile contactless payment methods, with usage continuing to grow year-over-year. The Monetary Authority of Singapore’s ongoing digital payment initiatives have created an ecosystem where cash transactions are increasingly rare in urban retail environments.

Key Payment Technologies Reshaping Commerce

Near Field Communication (NFC)

NFC technology has become the backbone of Singapore’s contactless revolution. Major retailers report transaction times reduced by 15-25 seconds per customer when switching from cash to NFC payments. For a business processing 200 transactions daily during peak periods, this translates to saving over 80 minutes of queue time.

QR Code Payments

Singapore’s QR code infrastructure, built around PayNow and integrated with major platforms like GrabPay and FavePay, offers particularly strong value for smaller establishments. Implementation costs typically range from $50-200 for basic QR code setups, making it accessible for hawker stalls and independent cafes.

Integrated Mobile Wallets

The user base of super app Grab’s mobile wallet is expected to reach almost reach double figures by 2025, highlighting the growing importance of multi-platform payment acceptance.

A Practical Approach to Contactless POS System Modernization

Phase 1: Infrastructure Assessment (Week 1-2)

Begin with a comprehensive audit of your current payment processing capabilities. Document your existing hardware age, software version, and daily transaction volume. Most businesses discover that terminals older than 3-4 years require complete replacement rather than upgrades.

Key Assessment Questions:

- Does your current terminal support EMV contactless readers?

- Can your POS software process NFC and QR code transactions simultaneously?

- What are your peak transaction volumes during busy periods?

- Do you need portable solutions for events, pop-ups, or temporary booths?

Phase 2: Technology Selection (Week 3)

Choose solutions based on your specific business model rather than following competitors. A jewelry store in Orchard Road has vastly different needs than a zi char stall in Chinatown.

For Retail Environments:

- NFC-enabled terminals handle 85% of contactless transactions

- Integration with inventory management systems reduces reconciliation time

- Customer-facing displays improve transaction transparency

For F&B Operations:

- QR code solutions excel in table-service environments

- Mobile POS tablets enable order-taking at tables

- Kitchen display integration streamlines operations during peak hours

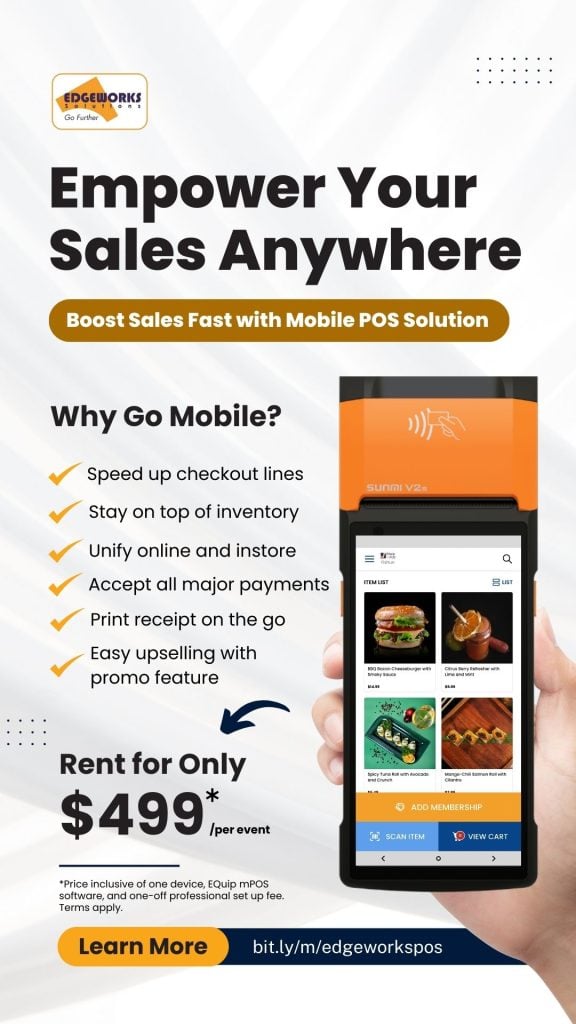

For Event Booths and Pop-Up Stores:

Mobile POS solutions have become essential for businesses participating in trade shows, night markets, and temporary retail setups. These portable systems transform smartphones or tablets into full-featured point-of-sale terminals, enabling businesses to accept contactless payments anywhere with cellular or WiFi connectivity. The flexibility proves particularly valuable during Singapore’s busy event season, where businesses often operate from temporary locations with limited infrastructure.

Phase 3: Implementation and Testing (Week 4-5)

Implement during your slowest business periods to minimize disruption. Run parallel systems for 48-72 hours to ensure reliability before fully transitioning.

Critical Testing Metrics:

- Transaction success rate (target: >99.5%)

- Average processing time per transaction

- Staff confidence scores with new equipment

- Customer wait time measurements

Phase 4: Staff Training and Customer Communication (Week 6)

Train staff during shift overlaps rather than scheduling separate training sessions. Most modern POS interfaces require only 2-3 hours of training for basic proficiency.

Create clear customer communication about new payment options. Simple table tents or door decals often prove more effective than digital announcements.

Measuring the Business Impact

Quantifiable Benefits

Transaction Speed Improvements

Independent studies show contactless payments reduce average transaction times from 45 seconds to 15 seconds. For businesses processing 150+ transactions daily, this improvement can serve 20-25 additional customers during peak hours.

Operational Efficiency Gains

- Cash handling time reduced by 60-75%

- End-of-day reconciliation time decreased by 30-45 minutes

- Staff productivity increases of 12-18% in payment processing tasks

Customer Satisfaction Metrics

Post-upgrade surveys consistently show:

- 67% of customers prefer contactless options

- 23% reduction in perceived wait times

- 15% increase in repeat visit frequency

Investment Considerations

Hardware Costs

- Basic NFC-enabled terminals: $300-800

- Integrated POS systems: $1,500-4,000

- Mobile POS solutions: $150-300/month subscription models

- Implementation and training: $500-1,200

Ongoing Expenses

- Processing fees: 1.5-2.8% of transaction value

- Monthly terminal fees: $25-75

- Mobile POS subscriptions: Typically $150/month (promotional rates often available)

- Software updates and support: $50-150/month

Most businesses achieve cost recovery within 8-14 months through efficiency gains and increased customer throughput. Mobile POS solutions often provide faster ROI for event-focused businesses due to their immediate deployment capability and lower setup costs.

Leveraging Singapore’s Event Calendar for Maximum Contactless POS System Impact

The period from August through November presents unique opportunities for businesses to showcase upgraded payment systems. This season sees numerous trade shows, pop-up markets, and promotional events where mobile POS capabilities become particularly valuable.

August-September Events

The Business Show Singapore (August 27-28, 2025)

The Business Show Singapore 2025 will be held from 27th – 28th August 2025 at Sands Expo & Convention Centre in Singapore. This event attracts over 300 exhibitors and thousands of entrepreneurs, creating ideal conditions for networking and technology demonstrations. Businesses using mobile POS systems can process transactions directly from their booths, eliminating the need for customers to queue at centralized payment points.

Mobile Contactless POS Systems for Event Success

For businesses participating in trade shows or operating temporary booths, mobile POS systems offer several competitive advantages:

Instant Setup Capability: Unlike traditional terminals requiring phone lines or ethernet connections, mobile POS solutions work anywhere with cellular coverage. Setup typically takes under 10 minutes, making them ideal for last-minute booth assignments or layout changes.

Professional Payment Processing: Modern mobile POS systems accept all major payment methods including contactless cards, mobile wallets, and QR code payments. This comprehensive acceptance helps capture sales from customers who prefer different payment methods.

Real-Time Inventory Sync: Advanced mobile POS platforms sync inventory data in real-time, preventing overselling of popular items during busy event periods. This capability proves particularly valuable for retailers showcasing limited-edition products or seasonal merchandise.

Seamless Integration: Mobile POS systems that integrate with existing business management platforms allow event sales to automatically update main inventory systems and customer databases, streamlining post-event reconciliation.

Industry-Specific Opportunities

The Singapore retail calendar includes numerous sector-specific events where upgraded POS systems can provide competitive advantages:

Trade Show Environments

F&B businesses participating in food festivals often see 30-40% higher transaction volumes compared to regular operations. Mobile POS systems prove essential in these scenarios, allowing vendors to process payments quickly during peak lunch and dinner rushes while maintaining professional service standards.

Pop-Up Retail Experiences

Retail brands using temporary spaces for product launches or seasonal promotions benefit significantly from portable payment solutions. The ability to accept all payment types without complex setup procedures enables businesses to focus on customer engagement rather than technical logistics.

Event Vendor Opportunities

Night markets, community festivals, and corporate events present lucrative opportunities for mobile vendors. Businesses equipped with reliable mobile POS systems often report 25-30% higher sales compared to cash-only operations, as they can serve customers who prefer digital payments.

Implementation Timeline for Event Season

6-8 Weeks Before Events:

Complete system selection and procurement. Lead times for professional-grade POS hardware currently range from 3-6 weeks.

4-5 Weeks Before Events:

Begin installation and integration testing. This allows time for troubleshooting without impacting event performance.

2-3 Weeks Before Events:

Complete staff training and customer communication rollouts. Early implementation helps identify and resolve issues before high-stakes event periods.

Event Week:

Monitor performance metrics closely and have technical support readily available. Many businesses report 20-35% higher transaction volumes during major events.

Regulatory and Compliance Considerations

Singapore’s payment processing regulations require specific security standards for contactless transactions. Ensure your chosen solution complies with:

- Payment Card Industry Data Security Standard (PCI DSS)

- Monetary Authority of Singapore’s electronic payment guidelines

- Goods and Services Tax (GST) reporting requirements for digital transactions

Moving Forward: Next Steps for Singapore Businesses

The transition to contactless payments isn’t just about technology—it’s about positioning your business for Singapore’s digital future. The Digital Payments market in Singapore is projected to grow by 18.23% (2023-2027) resulting in a market volume of US$40.68bn in 2027, indicating continued expansion in digital payment adoption.

Start with a thorough assessment of your current capabilities, choose technology that matches your specific business needs, and implement with sufficient time for proper training and testing. The businesses that act now will be best positioned to capitalize on the busy event season ahead.

For Singapore’s retail and F&B sectors, contactless payment capability has evolved from a nice-to-have feature to a fundamental business requirement. The question isn’t whether to upgrade, but how quickly you can implement these systems to serve your customers’ evolving expectations.

Looking to assess your current POS setup for contactless payment readiness? Consider scheduling a consultation to evaluate your specific needs and implementation timeline.

Key Takeaways

Act Now: More than nine in 10 Visa transactions made by Singapore consumers are contactless payments

Plan for Events: Peak season from August-November requires 6-8 weeks preparation time

Measure Success: Focus on transaction speed, customer satisfaction, and operational efficiency

Start Small: QR code solutions offer low-cost entry points for smaller businesses

Think Long-term: Digital payments market projected to reach US$40.68bn by 2027

Follow us on