The digital transformation of Singapore’s retail and F&B landscape is accelerating at an unprecedented pace. As we look toward the next five years, future-proof POS systems have become more than just transaction tools—they’re strategic business assets that can make or break an SME’s competitive advantage. With Singapore’s digital payment market projected to grow significantly and consumer expectations evolving rapidly, choosing the right point-of-sale solution is critical for sustainable business growth.

For Singapore SMEs navigating this digital revolution, understanding what makes a POS system truly future-ready is essential. The decisions you make today about your POS infrastructure will determine whether your business thrives or struggles in the increasingly competitive marketplace of tomorrow.

The Current State of Singapore’s POS Market

Singapore’s point-of-sale terminal market is experiencing robust growth, with projections indicating continued expansion through 2028. According to recent market analysis, the number of POS terminals in Singapore is expected to reach approximately 392,280 units by 2028, reflecting a compound annual growth rate (CAGR) of 2.64% from 2024 to 2028.

This growth is driven by several key factors:

Digital Payment Adoption: More than three-quarters of Singapore consumers now use credit or debit cards for payments, while over half utilize PayNow (55%) or bank transfers (55%). The shift toward cashless transactions has accelerated, with Generation Z leading this transformation and many small businesses already moving away from cash payments entirely.

Government Support: Singapore’s Smart Nation initiative continues to push for digital transformation across all sectors, creating a supportive ecosystem for businesses adopting advanced POS technologies.

Consumer Expectations: Today’s consumers expect seamless, fast, and secure payment experiences across multiple channels, forcing businesses to upgrade their payment infrastructure to remain competitive.

Essential Features for Future-Proof POS Systems

Cloud-Based Infrastructure

The foundation of any future-proof POS system lies in its cloud capabilities. Cloud-based POS systems offer numerous advantages over traditional on-premise solutions:

Scalability: Cloud systems can easily accommodate business growth without requiring significant hardware investments. As your business expands, your POS system scales with you.

Real-time Data Access: Access your business data from anywhere, at any time. This capability became crucial during the pandemic and remains essential for modern business operations.

Automatic Updates: Cloud-based systems receive regular updates automatically, ensuring you always have access to the latest features and security patches without manual intervention.

Cost Efficiency: Reduced upfront costs and predictable subscription models make cloud POS systems more accessible for SMEs with limited capital.

The Monetary Authority of Singapore’s digital transformation initiatives continue to support businesses in adopting cloud technologies, making this transition both strategic and supported by government policy.

Omnichannel Integration Capabilities

Modern consumers shop across multiple touchpoints—online, in-store, and through mobile apps. Future-proof POS systems must seamlessly integrate these channels:

Unified Inventory Management: Real-time inventory synchronization across all sales channels prevents overselling and ensures accurate stock levels.

Customer Data Unification: Combine customer data from all touchpoints to create comprehensive customer profiles and enable personalized experiences.

Consistent Pricing and Promotions: Ensure pricing consistency across all channels while maintaining the flexibility to run channel-specific promotions.

Order Fulfillment Flexibility: Enable buy-online-pickup-in-store (BOPIS) and other flexible fulfillment options that modern consumers expect.

Advanced Payment Processing

Singapore’s digital payment landscape is diverse and rapidly evolving. Future-proof POS systems must support:

Multiple Payment Methods: Integration with PayNow, GrabPay, WeChat Pay, Alipay, and other popular e-wallets alongside traditional card payments.

Contactless Payments: NFC-enabled payments and QR code transactions have become standard expectations, not optional features.

Buy Now, Pay Later (BNPL): Integration with popular BNPL platforms like Grab PayLater and other installment payment options.

Cryptocurrency Support: As digital currencies gain acceptance, forward-thinking POS systems should be prepared to support cryptocurrency transactions.

The Infocomm Media Development Authority (IMDA) continues to promote digital payment innovations, making it crucial for businesses to stay ahead of these trends.

Comprehensive Analytics and Reporting

Data-driven decision making is no longer optional—it’s essential for business survival and growth:

Sales Performance Tracking: Detailed sales reports broken down by time periods, product categories, and staff performance.

Customer Behavior Analytics: Insights into customer purchasing patterns, preferences, and loyalty trends.

Inventory Intelligence: Automated reorder points, slow-moving stock identification, and seasonal trend analysis.

Financial Reporting: Real-time profit and loss statements, tax reporting, and integration with accounting software.

Predictive Analytics: Advanced systems that can forecast trends and suggest business optimizations based on historical data.

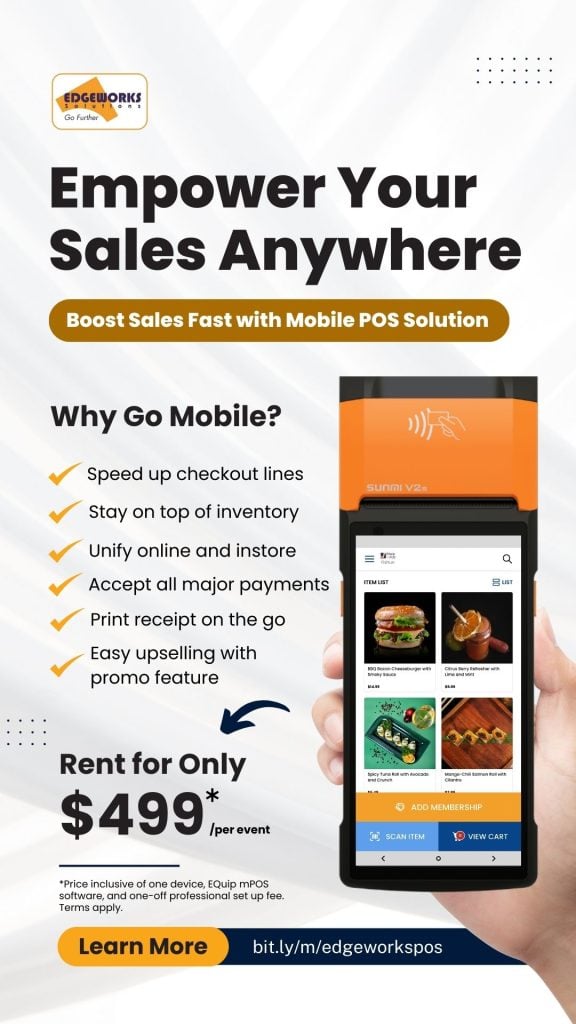

Mobile and Tablet Compatibility

The future of retail is mobile-first. Your POS system must offer:

Tablet-Based Solutions: Lightweight, portable POS terminals that can be used anywhere in your store or at off-site events.

Staff Mobile Access: Enable staff to access inventory information, process returns, and assist customers using mobile devices.

Customer-Facing Apps: Integration with mobile apps that allow customers to check prices, access loyalty programs, and make purchases independently.

Offline Functionality: Ensure your mobile POS can continue operating even during internet connectivity issues.

Image is for illustrative purposes only and may vary from the actual product.

Industry-Specific Considerations

Retail Businesses

Retail SMEs in Singapore need POS systems that can handle:

- Complex inventory management with variations (size, color, style)

- Seasonal stock planning and management

- Integration with e-commerce platforms like Shopify and Lazada

- Customer loyalty programs and referral systems

Food & Beverage Operations

F&B businesses require specialized features:

- Table management and reservation systems

- Kitchen display integration for order management

- Ingredient-level inventory tracking

- Integration with food delivery platforms like GrabFood and Foodpanda

Service-Based Businesses

Service providers need:

- Appointment scheduling and management

- Service package and membership handling

- Staff scheduling and commission tracking

- Customer communication tools

Choosing the Right POS Partner

Evaluation Criteria

When selecting a POS provider, consider:

Local Support: Choose providers with strong Singapore presence and local customer service.

Integration Capabilities: Ensure compatibility with your existing business tools and platforms.

Scalability: Verify that the system can grow with your business without requiring complete replacements.

Training and Support: Comprehensive training programs and ongoing support are essential for successful adoption.

Track Record: Look for providers with proven success stories among similar Singapore businesses.

Red Flags to Avoid

- Providers without local presence or support

- Systems with limited integration options

- Unclear pricing or hidden fees

- Poor customer reviews or testimonials

- Outdated technology or infrequent updates

Conclusion

The next five years will bring unprecedented changes to Singapore’s retail and F&B landscape. SMEs that invest in future-proof POS systems today will be positioned to capitalize on emerging opportunities while those clinging to outdated systems will struggle to compete.

The key to success lies not just in choosing a modern POS system, but in selecting one that aligns with your specific business needs, growth plans, and customer expectations. Cloud-based infrastructure, omnichannel integration, advanced payment processing, comprehensive analytics, and mobile compatibility are no longer nice-to-have features—they’re business necessities.

As Singapore continues its digital transformation journey, supported by government initiatives and changing consumer behaviors, the businesses that thrive will be those that embrace technology as a strategic advantage rather than viewing it as a necessary expense.

The investment in a future-proof POS system is an investment in your business’s long-term viability and growth potential. The question isn’t whether you can afford to upgrade—it’s whether you can afford not to.

Ready to Future-Proof Your Business?

Don’t let outdated POS systems hold your business back. At Edgeworks Solutions, we specialize in helping Singapore SMEs navigate the complex landscape of modern POS technology. Our team of experts will work with you to assess your current needs, design a customized solution, and ensure seamless implementation that drives real business results.

Take the first step toward a more profitable, efficient future. Contact Edgeworks Solutions today for a free consultation and discover how the right POS system can transform your business operations, improve customer satisfaction, and unlock new growth opportunities.

Schedule Your Free POS Assessment Now.

Transform your business today. Thrive in tomorrow’s market.

Follow us on