Singapore businesses are under attack. In 2024 alone, local businesses lost a staggering S$1.1 billion to scams and fraud. That’s not just a number – it’s money taken from hardworking business owners like you.

If you run a retail shop in Orchard Road or a kopitiam in Toa Payoh, you’re not safe from fraud. The numbers are scary. More than half of Singapore businesses now report increased fraud attempts. And here’s the thing – many of these attacks target your point-of-sale (POS) system.

Your POS system handles every transaction. It processes payments, manages cash, and stores customer data. When fraudsters attack your POS, they can steal money, customer information, and destroy your reputation overnight.

But there’s good news. Modern POS systems come with powerful security features that can protect your business. In this guide, we’ll show you exactly what security features your business needs. You’ll learn about compliance requirements, see examples, and understand why investing in POS security actually saves you money.

The Current Fraud Landscape in Singapore

The fraud situation in Singapore is getting worse, not better. And it’s hitting businesses hard. Singapore businesses lost S$1.1 billion to scams in 2024. Police reported 50,376 scam cases in 2023 – that’s a massive 49.6% increase from 2022.

Think about it this way: nearly half of Singapore consumers have experienced fraudulent attempts. And 52% of businesses report rising fraud attempts. Across Asia, consumers lost $700 billion collectively to digital scams in 2024.

You might think, “That won’t happen to my business.” But fraud doesn’t discriminate. Whether you run a small provision shop or a chain of restaurants, you’re a target.

Common POS-Related Fraud Types Affecting Singapore Businesses

Here are the most common fraud types that target Singapore businesses through their POS systems:

Receipt fraud is becoming very common. Customers ask for receipt reprints, then use them to claim additional refunds from shopping malls. This might sound harmless, but it adds up quickly.

Internal cash theft happens when staff manipulate cash drawer operations. They might take money during shifts or create fake transactions to cover their tracks.

Refund fraud occurs when people return items without proper verification. They might use fake receipts or return stolen goods.

Card skimming and data theft target your payment processing systems. Fraudsters install devices that steal customer card information during transactions.

Transaction manipulation involves unauthorized voids and transaction modifications. Staff might cancel legitimate sales and pocket the cash.

Multi-outlet fraud is especially dangerous if you have multiple locations. Part-time staff might access systems at locations where they shouldn’t be working.

The Real Cost Beyond Financial Loss

The money you lose to fraud is just the beginning. When fraud hits your business, you also face:

- Customer trust erosion and reputation damage

- Regulatory compliance violations and penalties

- Operational disruption from fraud investigations

- Staff-related risks and trust issues

As security experts say, there are “serious consequences if staff break the rules, if they break the trust.” The damage goes far beyond the immediate financial loss.

Essential POS Security Features

7 Advanced POS Security Features Every Singapore Business Must Have

Your POS system is like the vault in a bank. It needs multiple layers of protection. Here are the seven essential security features that every business should have:

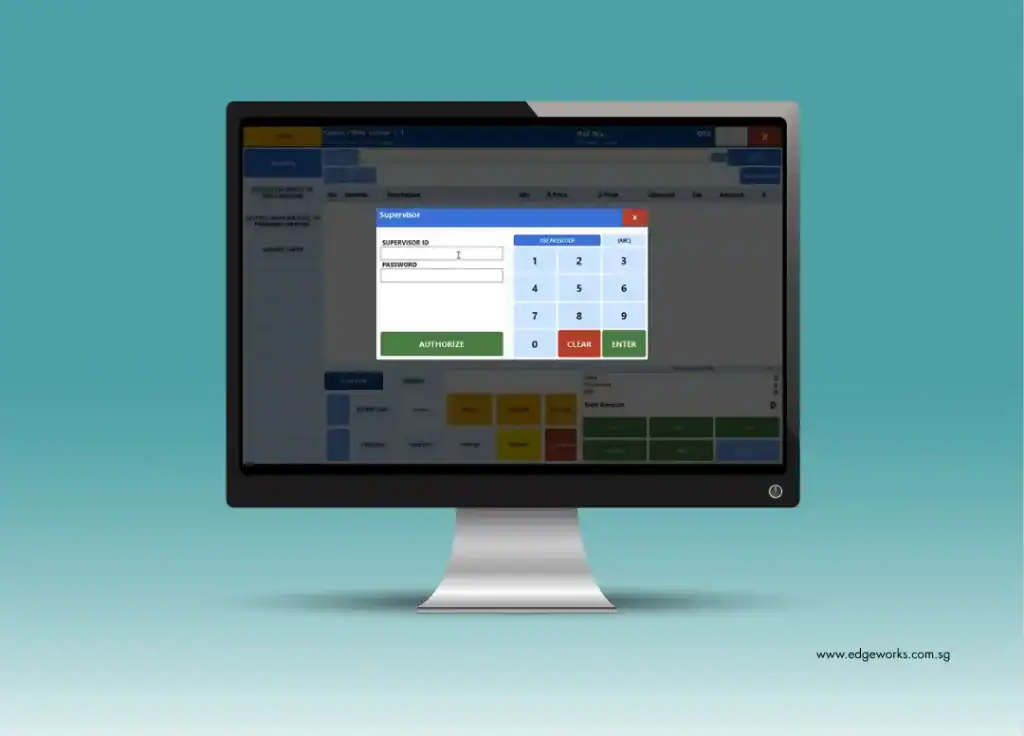

Role-Based Access Control & User Management

Not everyone in your business needs access to everything. Think about it – should your part-time cashier be able to process refunds? Should they access sales reports from other outlets?

Modern POS systems let you create different user roles. You can set up cashier accounts, supervisor accounts, and admin accounts. Each role has different permissions.

For example, cashiers can process sales but need supervisor approval for refunds. Supervisors can access daily reports but can’t change system settings. Only admins can modify user accounts and system configurations.

Here’s a real-world example: You can restrict part-time staff to only access the outlet where they work. This prevents them from logging into other locations and protects your business from unauthorized access.

The best part? Modern systems require passwords for sensitive operations like refunds, voids, and cash drawer access. This creates what experts call “psychological security barriers” – staff know the system is watching.

Transaction Audit Trail & Monitoring

Every transaction in your business should leave a paper trail. Not just for accounting, but for security.

Good POS systems track everything in real-time. They record who processed each transaction, when it happened, and what was done. If someone processes a refund, the system logs their name, the time, and the reason.

This helps you catch problems early. You can see if one staff member is processing too many voids. You can track which items are being refunded most often. You can even see patterns that might indicate fraud.

The audit trail also protects honest staff. If there’s a dispute about a transaction, you have complete records to prove what really happened.

Secure Cash Management

Cash handling is where most internal fraud happens. That’s why modern POS systems have special features to protect your cash.

Blind closing is one of the most important features. When staff close the register at the end of their shift, they can’t see how much money the system thinks should be there. They just count the actual cash and enter that amount.

This prevents staff from “adjusting” the cash to match what they think should be there. If money is missing, you’ll know immediately.

The system also requires reason codes for opening the cash drawer. Staff can’t just open it whenever they want. They must select a reason from a list – like “customer needs change” or “cash drop.” The system prints a slip that can be signed and kept as a record.

Automated daily closing happens after business hours. The system automatically closes the day’s transactions, so staff can’t go back and make changes later.

Receipt Security & Anti-Fraud Measures

Receipts might seem harmless, but they’re often used for fraud. Here’s how modern POS systems protect you:

Barcode scanning for refunds means customers must bring their original receipt. The system scans the barcode to verify the transaction actually happened. No barcode? No refund.

Hidden reprint options prevent customers from getting multiple copies of receipts. Some customers ask for reprints so they can claim refunds from shopping malls multiple times.

Supervisor approval is required for sensitive transactions. If a customer wants to return an expensive item, your supervisor must approve it with their password.

This is especially important in Singapore, where mall refund fraud is common. Customers might buy something, get a receipt reprint, then try to return the item at multiple locations.

End-to-End Encryption

When customers pay with cards, their payment information travels through several systems. End-to-end encryption protects this data during transmission.

Think of it like sending a letter in a locked box. Even if someone intercepts the box, they can’t read the letter inside without the key.

Modern POS systems encrypt payment data from the moment the card is swiped until it reaches the bank. This integration works seamlessly with payment networks like NETS and Visa.

PCI DSS compliance is built into this process. This means your system automatically meets the security standards required by card companies.

Automated Security Protocols

The best security features work automatically. You don’t want to rely on staff to remember security procedures.

Modern systems enforce transaction completion. For example, the cash drawer must be closed before the next sale can begin. This prevents staff from leaving drawers open where money could go missing.

Automatic daily closing happens after specified hours. The system locks down transactions for the day, so no one can go back and make unauthorized changes.

Configurable security levels let you adjust protection based on your business needs. A high-end boutique might need stricter controls than a neighborhood provision shop.

The key is creating what experts call “psychological security barriers.” When staff know the system is monitoring everything, they’re much less likely to try anything dishonest.

Multi-Payment Security Integration

Singapore customers pay in many ways – cash, cards, PayNow, GrabPay, and more. Your POS system needs to secure all these payment methods.

Secure processing works across all payment types. Whether someone pays with cash or digital wallet, the system applies the same security protocols.

Real-time verification checks every payment as it happens. If something looks suspicious, the system can flag it immediately.

Integrated fraud detection works across all payment methods. The system learns normal patterns and alerts you when something unusual happens.

The True Cost of Payment Fraud: Why Secure POS Systems Pay for Themselves

Many Singapore business owners think POS security is expensive. But here’s the truth – fraud costs much more than prevention.

Hidden Costs of Fraud Incidents

When fraud hits your business, the stolen money is just the beginning. Here are the real costs:

Direct financial losses include stolen cash, fraudulent refunds, and chargebacks from card companies. A single incident can cost thousands of dollars.

Reputation damage is harder to measure but often more expensive. Word spreads fast in Singapore’s tight business community. One fraud incident can drive customers away for months.

Compliance penalties from MAS and other authorities can be substantial. Businesses that fail to protect customer data face fines that can reach hundreds of thousands of dollars.

Customer trust erosion affects your long-term revenue. Once customers lose trust, they shop elsewhere. Rebuilding that trust takes time and money.

Operational disruption happens during fraud investigations. Staff spend time dealing with police reports instead of serving customers. You might need to close temporarily while investigations happen.

ROI of Security Investment

Now let’s talk about the good news. Investing in POS security actually saves money:

Prevention vs. remediation costs: A robust POS security system might cost a few thousand dollars. But recovering from fraud can cost tens of thousands.

Customer confidence boost: When customers know you take security seriously, they’re more likely to shop with you. They’ll also spend more per transaction because they trust your business.

Operational efficiency gains: Secure POS systems often include features that streamline operations. Better inventory tracking, automated reporting, and staff management tools all improve your bottom line.

Here’s a simple example: A restaurant in Clarke Quay invested S$5,000 in a secure POS system. Within six months, they caught an employee who was stealing S$200 per week. The system paid for itself in just 25 weeks – and continues protecting the business every day.

Staff productivity improvements happen when you reduce time spent on manual security checks and fraud investigations. Automated security features free up your staff to focus on customers.

See Advanced POS Security Features in Action

Watch this comprehensive demonstration.

As highlighted in the demonstration, “we need to balance between operational efficiency and security processes” – and this video shows you exactly how successful businesses achieve this balance.

The video demonstrates configurable security features that adapt to your specific needs. You’ll see how over-implementing security can disrupt customer experience, and how smart systems avoid this problem.

Secure Your Business Future with Advanced POS Security

Singapore’s fraud crisis is real, and it’s getting worse. With businesses losing S$1.1 billion to scams in 2024, you can’t afford to wait. Every day you operate without proper POS security, you’re taking unnecessary risks with your business.

But here’s the good news: the solution is available right now. Modern POS systems offer comprehensive security features that protect against the most common fraud types affecting Singapore businesses:

- Role-based access control prevents unauthorized transactions

- Blind closing and audit trails protect your cash handling

- Receipt fraud prevention stops common retail scams

- Automated security protocols work 24/7 to protect your business

- Real-time monitoring catches problems before they become expensive

Remember, prevention is always better than cure. The cost of implementing proper POS security is a fraction of what fraud can cost your business. One serious fraud incident can wipe out months of profits and damage your reputation for years.

Your next steps:

- Assess your current security gaps – Where is your business vulnerable right now?

- Contact our team for a personalized security consultation – We’ll show you exactly how advanced POS security can protect your specific business

- See the features in action – Request a demonstration tailored to your industry and business size

Ready to protect your business from Singapore’s growing fraud crisis?

Contact Edgeworks today for a free assessment. Our experts will evaluate your current setup and show you exactly how advanced POS security features can protect your business while improving your operations.

Don’t wait for fraud to find your business. Take action now.